Form 6765 instructions guide businesses on claiming the IRS R&D tax credit by explaining eligibility, qualified research expenses, calculation methods, and documentation required for accurate and compliant filing.

Table of Contents

- Introduction to Form 6765

- What Is Form 6765 Used For?

- Why the R&D Tax Credit Still Matters in 2026?

- Who Qualifies for the R&D Tax Credit?

- What Are Qualified Research Expenses (QREs)?

- IRS Form 6765 Instructions Explained Step by Step

- Instructions for Form 6765: Regular vs ASC Method

- How to Calculate ASC vs Regular Method?

- Can Startups Use Payroll Offset?

- What Documents Are Required?

- Form 6765 Instructions 2025 vs 2026 Perspective

- Common Filing Mistakes Businesses Still Make

- How Proper Filing Improves Audit Safety?

- Booksmerge Insight on Form 6765 Compliance

- Conclusion

- FAQs

Introduction to Form 6765

Innovation is expensive. The IRS knows this, which is why Form 6765 exists. It allows businesses to recover a portion of their research and development costs through a federal tax credit.

Still, many companies skip the credit or file it incorrectly. Some fear audits. Others feel overwhelmed by the technical language in IRS Form 6765 instructions. Both reactions are understandable. Tax forms rarely spark joy.

This guide explains Instructions Form 6765 in plain English, with logic, structure, and just enough humor to keep things human. No fluff. No fake data. Just what works in 2026.

What Is Form 6765 Used For?

Form 6765 is used to claim the federal Research and Development Tax Credit under Internal Revenue Code Section 41.

Businesses file it to:

- Reduce federal income tax

- Offset payroll taxes if eligible

- Recover costs related to innovation and experimentation

The IRS confirms that eligible research includes product development, process improvement, software creation, and engineering experimentation. Even failed projects can qualify. Failure counts in science. It also counts in taxes.

Why the R&D Tax Credit Still Matters in 2026?

The R&D tax credit remains one of the most valuable incentives in the U.S. tax system. Congress continues to support innovation because innovation fuels productivity and job creation.

According to IRS guidance, thousands of small and mid-sized businesses claim this credit each year. Yet many eligible companies never file. They assume the credit only applies to large corporations. That assumption costs money.

In 2026, compliance matters more than ever. The IRS focuses heavily on documentation, clarity, and consistency. Filing Form 6765 correctly is no longer optional. It is essential.

Who Qualifies for the R&D Tax Credit?

Many industries qualify, not just tech.

Eligible businesses often include:

- Software development firms

- Manufacturers and fabricators

- Engineering and architecture firms

- Life sciences and biotech companies

- Startups building new products

To qualify, activities must meet the IRS four-part test:

- A permitted purpose such as improving performance or quality

- Elimination of technical uncertainty

- A process of experimentation

- A foundation in science or engineering

The IRS outlines this framework clearly in official R&D credit guidance. If your team experiments, tests, refines, or prototypes, you may qualify.

What Are Qualified Research Expenses (QREs)?

QREs are the foundation of instructions for Form 6765. Without them, there is no credit.

Qualified Research Expenses typically include:

- Wages paid to employees performing R&D

- Supplies consumed during research

- Contract research expenses, usually limited to 65 percent

Non-qualifying costs include marketing, training, and general administration. Coffee used during late-night coding does not qualify, even if it feels essential.

Accurate classification protects your claim and reduces audit risk.

Quick Tip: An IRS form list is a simple directory of official tax forms that helps individuals and businesses quickly identify, download, and file the correct IRS documents with confidence.

IRS Form 6765 Instructions Explained Step by Step

Form 6765 contains four main sections:

Part I: Regular Credit

Used by businesses with historical base period data.

Part II: Alternative Simplified Credit

The most commonly used method today. It simplifies calculations and reduces recordkeeping.

Part III: Credit for Increasing Research Activities

Coordinates Form 6765 with other credits.

Part IV: Payroll Tax Offset

Allows eligible startups to apply the credit against employer payroll taxes.

Understanding which sections apply saves time and prevents overreporting.

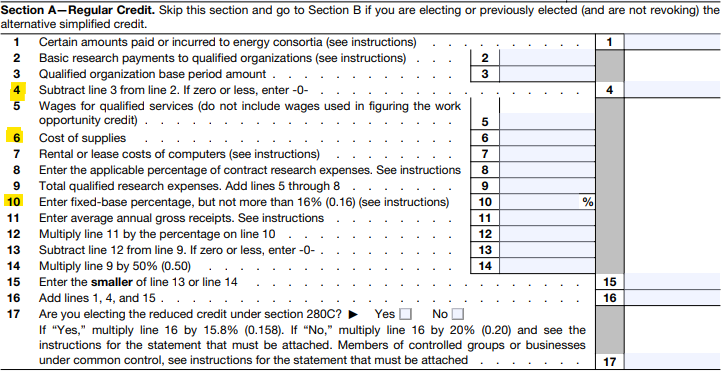

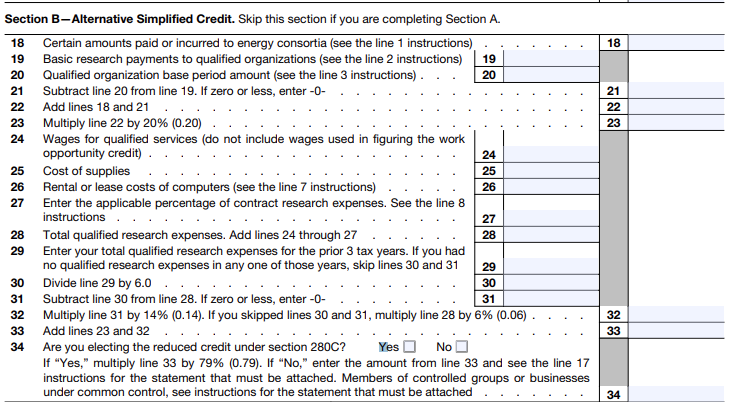

Instructions for Form 6765: Regular vs ASC Method

Choosing the right calculation method matters.

The Regular Credit method compares current QREs to a historical base period. It requires detailed records going back many years.

The Alternative Simplified Credit method uses a rolling three-year average. Most businesses prefer ASC because it requires less historical data and reduces audit exposure.

The IRS openly encourages ASC adoption due to its simplicity and reliability.

How to Calculate ASC vs Regular Method?

Here is the simple breakdown:

- ASC Method:

Credit equals 14 percent of QREs above 50 percent of the prior three-year average. - Regular Method:

Credit depends on fixed base percentage calculations tied to historical gross receipts.

In practice, ASC works best for most modern businesses. Regular method works when detailed historical records exist.

Can Startups Use Payroll Offset?

Yes. This feature remains one of the most valuable aspects of IRS Form 6765 instructions.

Qualified small businesses can apply up to $500,000 of R&D credits against employer payroll taxes.

Eligibility requirements include:

- Gross receipts under $5 million

- No gross receipts before the five-year window

This option helps startups preserve cash while funding innovation. Cash flow stays alive. Innovation continues.

What Documents Are Required?

The IRS expects real documentation, not estimates.

Required records often include:

- Payroll reports and wage summaries

- Time tracking or project allocation records

- Expense ledgers

- Technical project descriptions

- Design notes, testing logs, or code repositories

Strong documentation builds audit confidence and long-term compliance. Businesses with higher financial literacy tend to document better. For useful insights, explore this resource on small business financial awareness: Financial Literacy Statistics

Form 6765 Instructions 2025 vs 2026 Perspective

The structure of Form 6765 remains consistent, but enforcement has evolved.

In 2026, the IRS places greater emphasis on:

- Project-level documentation

- Clear linkage between expenses and activities

- Substantiation for software development claims

The IRS no longer accepts vague descriptions. Specificity matters. Clear logic wins.

Common Filing Mistakes Businesses Still Make

Even experienced companies make mistakes.

Common errors include:

- Including non-R&D wages

- Lacking technical explanations

- Using unsupported estimates

- Filing without contemporaneous records

These mistakes increase audit risk and delay refunds. Accuracy beats aggression every time.

How Proper Filing Improves Audit Safety

Clean filings build trust. With the IRS. With lenders. With investors.

Consistent compliance:

- Reduces audit exposure

- Improves tax planning outcomes

- Strengthens financial credibility

Trust grows when numbers match reality. That principle never changes.

Booksmerge Insight on Form 6765 Compliance

Booksmerge helps businesses navigate form 6765 instructions 2025 and beyond with clarity and precision.

Our team supports:

- QRE identification

- ASC vs regular method analysis

- Documentation preparation

- Payroll offset optimization

We focus on accuracy, compliance, and long-term trust. Need expert guidance now? Call +1-866-513-4656 and speak with professionals who value clarity over shortcuts.

You May Also Visit: how to fill out a 1040 form

Form 6765 remains a powerful tool for innovative businesses in 2026. When filed correctly, it delivers real tax savings without unnecessary risk.

Understanding IRS Form 6765 instructions empowers businesses to claim what they earn, document what they do, and grow with confidence.

Innovation deserves support. The tax code agrees.

Frequently Asked Questions

What is Form 6765 used for?

Form 6765 is used to claim the federal R&D tax credit for qualified research activities and expenses.

Who qualifies for R&D tax credit?

Businesses engaged in experimentation, development, or technical improvement may qualify, regardless of size or profitability.

What are QREs?

QREs are qualified research expenses, including wages, supplies, and contract research costs tied directly to R&D activities.

How to calculate ASC vs regular method?

ASC uses a three-year rolling average of QREs, while the regular method relies on historical base period data.

What documents are required?

Payroll records, expense reports, technical documentation, and project descriptions support a valid Form 6765 claim.

Can startups use payroll offset?

Yes. Eligible startups can apply up to $500,000 of the R&D credit against employer payroll taxes.

What changed in 2025 and continues into 2026?

The IRS increased scrutiny on documentation, especially for software claims, making accurate and detailed reporting more important than ever.

Read Also: Form 6765 Instructions

Need help with IRS Form 6765 instructions? Booksmerge is here to help. Call +1-866-513-4656 today.