In a world where borders matter less than vision, Indian entrepreneurs are increasingly looking beyond local markets. The United States, in particular, continues to attract founders who want credibility, scalability, and access to global opportunities. As a result, many business owners today aim to register company USA and open a bank account in USA from India to establish a strong international footprint.

At first glance, the process may feel overwhelming. Different regulations, banking requirements, and documentation standards can raise questions. However, with the right guidance and a clear roadmap, these steps become both manageable and empowering. Once you understand the basics, you can confidently move toward building a U.S.-ready business.

Why the USA Is a Top Choice for Indian Entrepreneurs

The United States offers one of the most business-friendly ecosystems in the world. First of all, it provides access to a massive consumer base and international clients. Additionally, U.S.-registered companies enjoy higher trust among investors, vendors, and global partners.

Moreover, U.S. laws offer strong protection for businesses and intellectual property. Because of this, startups feel more confident launching innovative ideas. Therefore, when Indian founders decide to register a company in USA, they are not just expanding geographically—they are designing a platform for long-term growth.

What Does It Mean to Register Company USA?

To register company USA means legally forming a business entity under U.S. law. Once registered, your business becomes a recognized legal entity that can operate, enter contracts, receive payments, and comply with U.S. tax regulations.

Importantly, you do not need to be physically present in the United States to complete this process. Indian residents can register a U.S. company remotely with proper documentation and professional assistance. This flexibility makes the USA an attractive destination even for first-time global entrepreneurs.

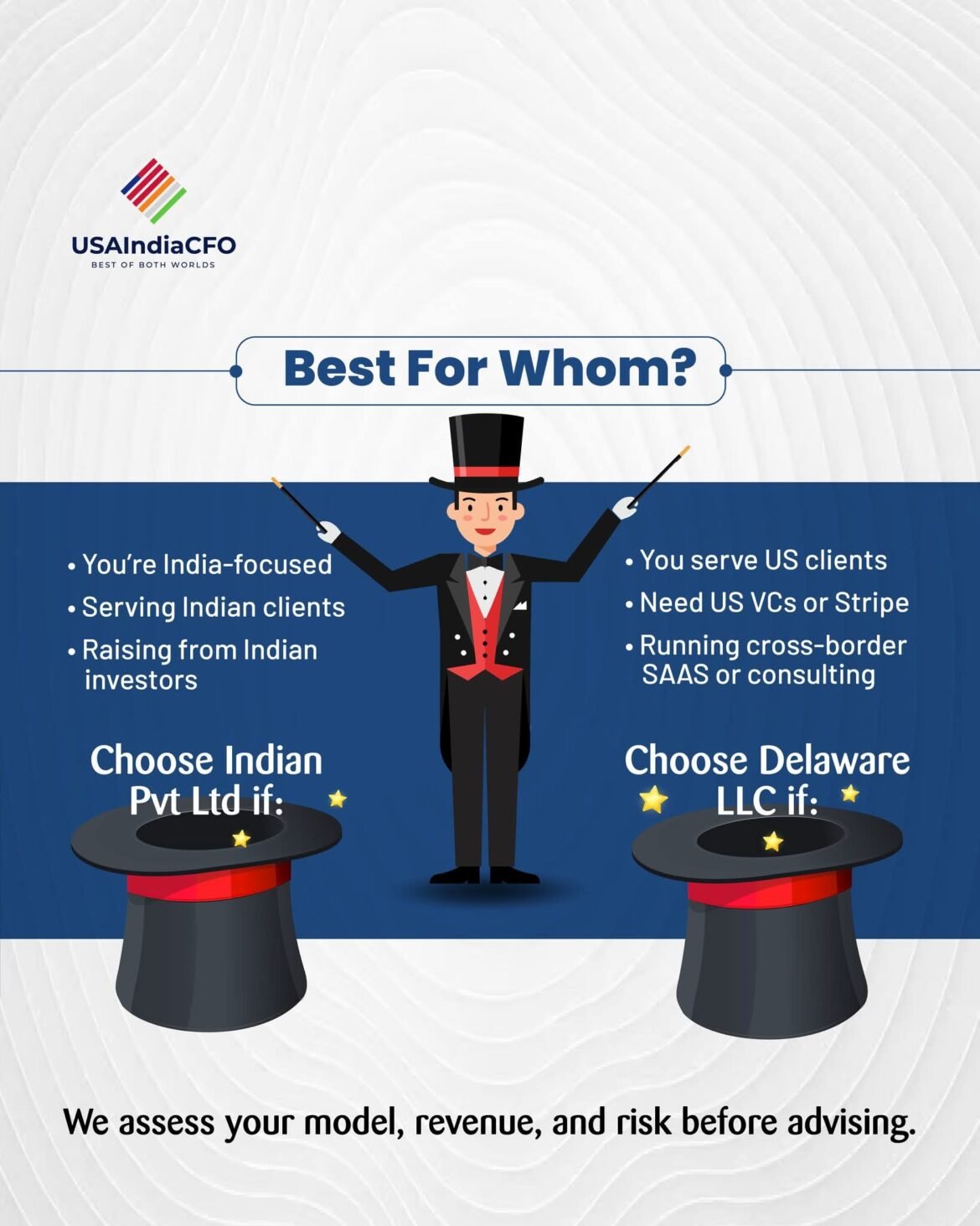

Choosing the Right Business Structure

Before you proceed, selecting the right business structure is essential. The most popular options include:

Limited Liability Company (LLC)

An LLC is ideal for beginners. It offers flexibility, limited liability, and relatively simple compliance. As a result, many Indian founders choose this structure when they register company USA.

C-Corporation (C-Corp)

A C-Corp works well for startups planning to raise venture capital or scale aggressively. Although compliance requirements are higher, it allows easier fundraising and equity distribution.

Choosing the right structure lays the foundation for your company’s financial and operational success.

Step-by-Step: How to Register Company USA from India

Step 1: Select the State

Each U.S. state has its own rules. States like Delaware, Wyoming, and Florida are popular due to business-friendly laws. Therefore, choosing the right state is a strategic decision.

Step 2: Finalize the Company Name

Next, choose a unique business name that complies with state guidelines. This name becomes your brand’s identity in the U.S. market.

Step 3: Appoint a Registered Agent

Every U.S. company needs a registered agent with a physical U.S. address. This agent receives legal notices and official documents on your behalf.

Step 4: File Incorporation Documents

You then submit official documents to register your company. Once approved, your business becomes a legally recognized U.S. entity.

With these steps completed, you are ready for the next crucial milestone—banking.

Why Opening a U.S. Bank Account Matters

Once you register company USA, opening a business bank account becomes essential. A U.S. bank account allows you to receive payments from American clients, pay vendors, manage expenses, and maintain financial transparency.

Furthermore, many global payment gateways and platforms require a U.S. bank account. Therefore, the ability to open a bank account in USA from India significantly improves operational efficiency and credibility.

How to Open a Bank Account in USA from India

Previously, opening a U.S. bank account required physical travel. However, today’s digital banking options and expert support have simplified the process.

Key Requirements Typically Include:

- U.S. company incorporation documents

- Employer Identification Number (EIN)

- Passport and identity verification

- Business details and activity description

With the right preparation, Indian entrepreneurs can complete this process remotely and securely.

Common Challenges Beginners Face

Despite simplified systems, beginners often face hurdles. These include documentation errors, compliance confusion, and uncertainty about banking eligibility. Additionally, coordinating between incorporation and banking timelines can feel stressful.

That’s why professional support plays a critical role. A knowledgeable partner ensures accuracy, saves time, and eliminates guesswork.

USAIndiaCFO: Designing One-of-a-Kind Global Business Spaces

What truly sets USAIndiaCFO apart is its design-led approach. Instead of treating incorporation and banking as transactional steps, USAIndiaCFO creates imaginative, one-of-a-kind spaces where businesses can grow confidently.

They start by understanding your vision, business model, and long-term goals. Then, they design a customized roadmap that seamlessly connects company registration and banking. As a result, the journey feels structured, creative, and empowering rather than confusing.

A Design Leader Beyond Traditional Services

USAIndiaCFO does more than help you register company USA or open a bank account in USA from India. They design ecosystems where compliance, strategy, and scalability coexist.

Their approach ensures that every legal and financial decision fits into a bigger picture. Consequently, founders gain clarity, confidence, and control over their global expansion.

Benefits of Registering a Company and Opening a U.S. Bank Account

When done correctly, these steps unlock powerful advantages:

- Enhanced global credibility

- Seamless international payments

- Access to U.S. clients and partners

- Stronger financial transparency

- Scalable business operations

Together, these benefits help Indian entrepreneurs compete on a global stage.

Why Beginners Should Start Now

Many founders delay action due to uncertainty. However, starting early allows you to build structure, test markets, and grow strategically. Once you understand how to register company USA and open a bank account in USA from India, the process becomes far less intimidating.

With a design-focused partner like USAIndiaCFO, global expansion transforms into an inspiring journey rather than a bureaucratic challenge.

Final Thoughts

For beginners, entering the U.S. market may feel like a big leap. However, with the right guidance, it becomes a well-designed step toward global success. By combining compliance expertise with imagination, USAIndiaCFO helps entrepreneurs build businesses that are not only legally sound but also creatively structured for growth.

If you’re ready to think bigger, build smarter, and operate globally, now is the perfect time to begin your U.S. business journey.

USAIndiaCFO – Virtual CFO Services in India

Office No 3, 4th Floor, Parth Business Plaza, Mith Chowki, above Zenith Multispeciality Hospital, Malad, Orlem, Malad West, Mumbai, Maharashtra 400064

Phone: 085914 00280

email : contact@usaindiacfo.com

Website: https://usaindiacfo.com/